The we_can ranking 2025

The year 2024 proved turbulent for the CEE media markets, as significant economic changes have formed both the economies and the advertising markets, mainly through inflation. Partly due to this inflationary pressure, the economy and the media industry managed to post visible growth.

Although surprisingly digital was only the second most dynamically growing market after radio, the increase in online from 2023 to 2024 accounted for 853 million euros, which pushed the markets overall.

The methodology of the we_can ranking

The we_can ranking is an index that shows the percentage of the ad spending per capita within a country’s nominal GDP. (The advertising spending data used in the yearly market overview and the we_can ranking consists of the TV, radio, print and OOH net spending figures, measured locally and converted into Euro – and the digital net ad spending measured by local IAB chapters or leading advertising associations, also converted into Euro.) We calculated both baseline data (GDP per capita and ad spending per capita) using the number of population older than 14 to ensure that the basis of the calculation only includes advertising target groups with independent purchasing power. we_can ranking reveals whether the advertising market as an economic sector is stronger or weaker than what the overall economic performance of a country would suggest.

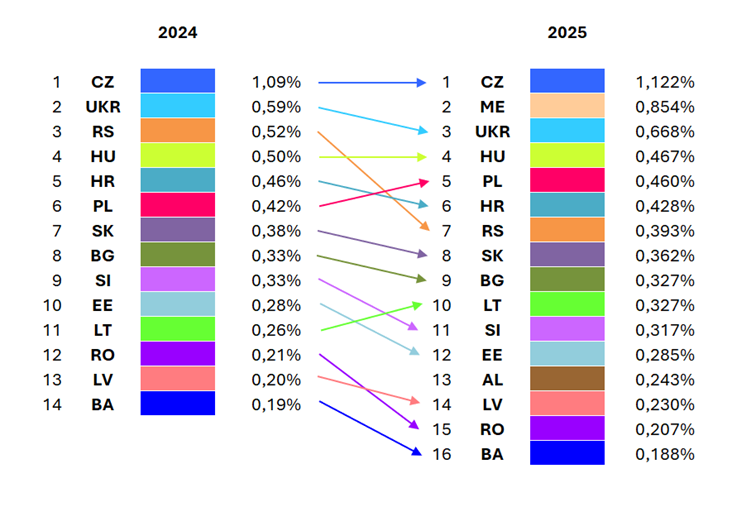

Even though media markets in the region managed to grow in 2024, some of them even boasting over 20% (Lithuania, Poland and Ukraine) or 10% (Romania) YoY expansion, they couldn’t always keep up the growth rate they showed the previous year, compared to the whole economy.

Some of the biggest markets, such as Poland, Ukraine and the Czech Republic showed more intense growth in this field in 2024, however in several cases, e.g. in Hungary, Croatia, Serbia, Slovakia and Slovenia the previous year’s rate of expansion of the media market compared to the whole economy could be maintained.

Most countries fell back from last year’s position, but this was also affected by the fact that this year, two new countries were added to the regional overview, Albania and Montenegro. And most notably, Montenegro rearranged the list from the top: with its 0,85% value, the country jumped to the second place, which means that the advertising market there has more dynamic expansion compared to the country’s economy, than for example in Hungary or Poland.

The overall ranking hasn’t changed dramatically though, the front runners are still some of the biggest markets (CZ, UKR, HU, PL) with the surprising new addition of Montenegro, while the lowest ranking trio of Latvia, Romania and Bosnia and Herzegovina only switched placed compared to last year, similarly to smaller, but better performing markets in the middle of the list.

Published: September 17, 2025